Scope of Duties

The main function of the Functional Committee is to supervise the following matters:

- Fair presentation of the financial reports of the Company.

- The hiring (and dismissal), independence, and performance of certificated public accountants of the Company.

- The effective implementation of the internal control system of the Company.

- Compliance with relevant laws and regulations by the Company.

- Management of the existing or potential risks of the Company.

The powers of the Committee are as follows:

- The adoption of or amendments to the internal control system pursuant to Article 14-1 of “Securities and Exchange Act”.

- Assessment of the effectiveness of the internal control system.

- The adoption or amendment, pursuant to Article 36-1 of “Securities and Exchange Act”, of the procedures for handling financial or business activities of a material nature, such as acquisition or disposal of assets, derivatives trading, loaning of funds to others, and endorsements or guarantees for others.

- Matters in which a director is an interested party.

- Asset transactions or derivatives trading of a material nature.

- Loans of funds, endorsements, or provision of guarantees of a material nature.

- The offering, issuance, or private placement of equity-type securities.

- The hiring or dismissal of a certified public accountant, or their compensation.

- The appointment or discharge of a financial, accounting, or internal audit officer.

- Annual and semi-annual financial reports, with the exception of semi-annual financial reports that are not required under relevant laws and regulations to be audited and attested by a certified public accountant (CPA).

- Other material matters as may be required by the Company or by the competent authority.

The matters under the preceding paragraph shall be subject to the approval of one half or more of the entire membership of the Committee and shall be submitted to the Board of Directors for a resolution.

The Committee shall exercise the care of a good administrator to faithfully perform the following duties and present its recommendations to the Board of Directors for discussion:

- Periodically reviewing the Charter and making recommendations for amendments.

- Establishing and periodically reviewing the annual and long-term performance goals for the directors and managerial officers of the Company and the policies, systems, standards, and structure for their compensation. The result of assessment should be disclosed in yearly reports and be reported at the annual general meeting.

The Committee shall perform the duties under the preceding paragraph in accordance with the following principles:

- Performance assessments and compensation levels of directors and managerial officers shall take into account the general pay levels in the industry, the time spent by the individual and their responsibilities, the extent of goal achievement, their performance in other positions, and the compensation paid to employees holding equivalent positions in recent years. Also to be evaluated are the reasonableness of the correlation between the individual's performance and the Company's operational performance and future risk exposure, with respect to the achievement of short-term and long-term business goals and the financial position of the Company.

- There shall be no incentive for the directors or managerial officers to pursue compensation by engaging in activities that exceed the tolerable risk level of the Company

- For directors and senior managerial officers, the percentage of bonus to be distributed based on their short-term performance and the time for payment of any variable compensation shall be decided with regard to the characteristics of the industry and the nature of the Company's business

- No member of the Committee may participate in discussion and voting when the Committee is deciding on that member's individual compensation.

"Compensation" as used in the preceding two paragraphs includes cash compensation, stock options, profit sharing and stock ownership, retirement benefits or severance pay, allowances or stipends of any kind, and other substantive incentive measures.

If the decision-making and handling of any matter relating to the compensation of directors and managerial officers of a subsidiary is delegated to the subsidiary but requires ratification by the Board of Directors of the Company, the Committee shall be asked to make recommendations before the matter is submitted to the Board of Directors for deliberation.

The main function of Special Committee on Merger and Acquisition is to deal with the following matters:

Audit based on the fairness and reasonability of mergers and acquisitions plans, and they should report the auditing result to board meetings and annual general meetings. But based on the law of mergers and acquisitions, when the decision does not need to be made during the annual general meeting, there is no need to report the result to the meeting.

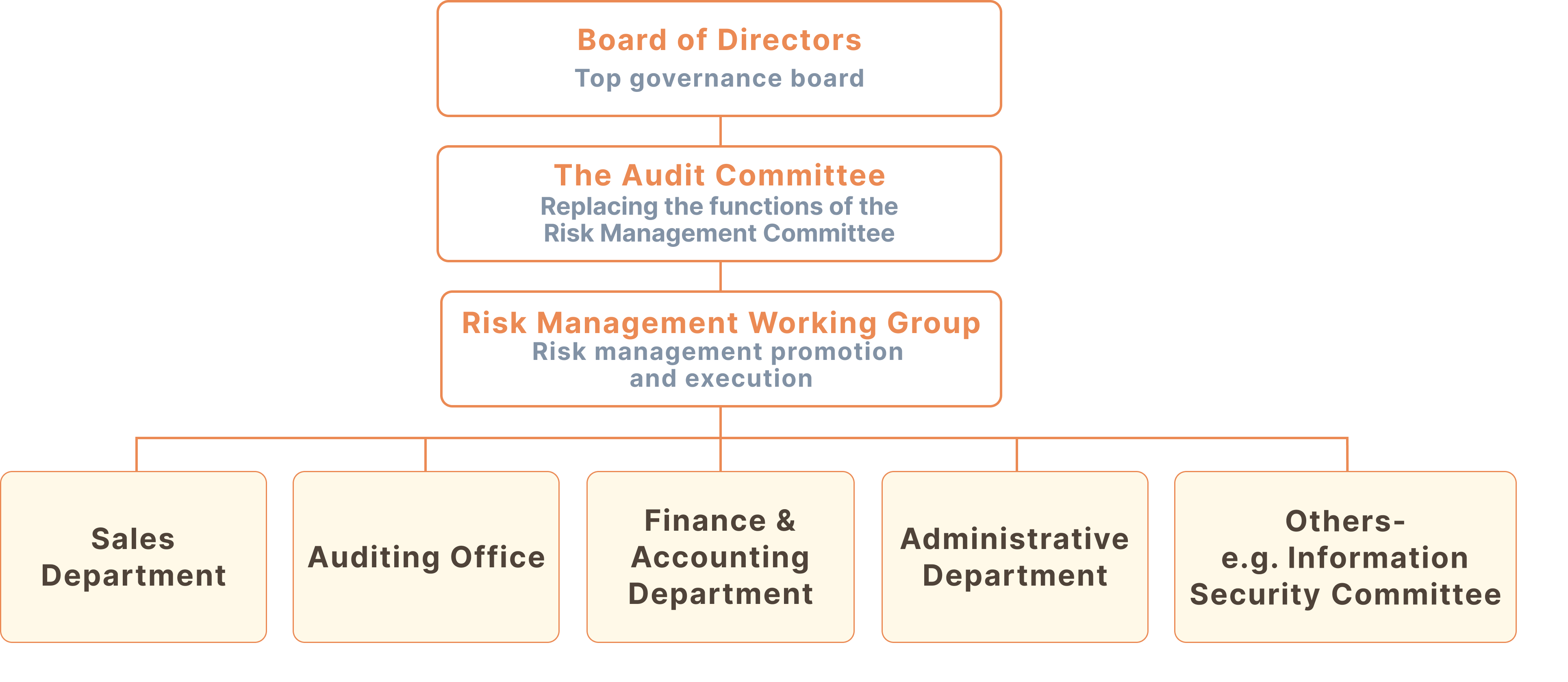

Risk Management Committee (replaced by the Audit Committee)

In order to assist the company to establish a sound risk management system and move towards the goal of sustainable development of the business in a stable manner, please refer to the "Risk Management Code of Practice for Listed OTC Companies" formulated by the competent authority to formulate the company's risk management code of practice to strengthen risk management system. On December 5, 2011, the 12th meeting of the seventh session of the board of directors approved the formulation of the "Risk Management Practice Code", except for the resolution that the Audit Committee replace the functions of the Risk Management Committee, and report the company's risk management policies, procedures and scope.

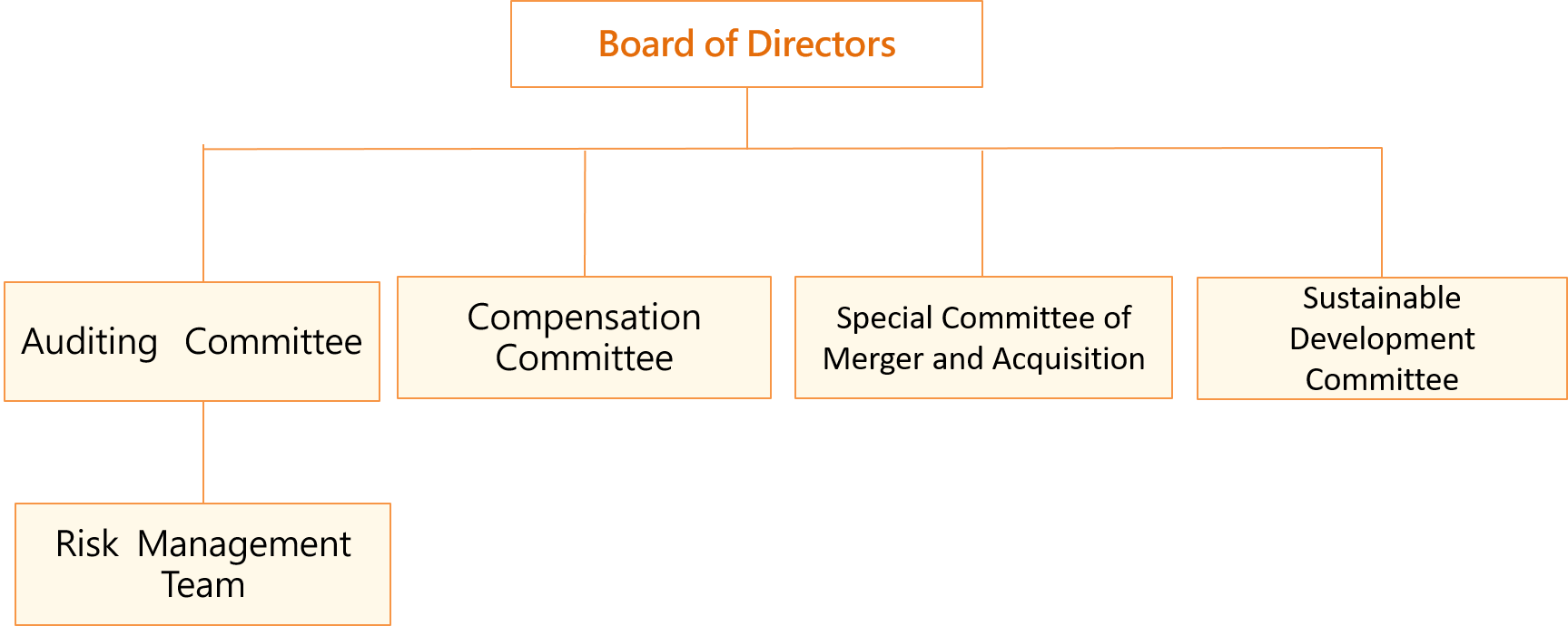

The company's board of directors is the highest governance unit for risk management. In addition, it is one of the responsibilities of the audit committee to supervise audit operations. In addition, the auditors have identified various possible risks when performing audit operations, and recorded risk analysis, evaluation, and response suggestions in the audit report, and regularly report the audit implementation status to the members of the audit committee. The function of risk management already exists, so there is no additional risk management committee, and the function of the risk management committee will be replaced by the audit committee. Promotion and execution unit. The organizational structure of risk management is as follows:

Note: Please refer to the company's code of practice for risk management for the various responsibilities and roles of the organizational structure

- Risk management policies include: risk management objectives, risk governance and culture, risk management organizational structure and responsibilities, risk management procedures, and risk reporting and disclosure. Through the support and supervision of governance units and senior executives, link risk management with the company's strategic goals, set the company's major risk projects, improve the comprehensiveness, forward-looking and completeness of risk identification results, and link corresponding risk control and Response measures are issued to the front-line employees to reasonably ensure the achievement of the company's strategies and goals.

- Risk management procedures include: risk identification, risk analysis, risk assessment, risk response and supervision and review mechanism. The risk management execution process and its results should be recorded, reviewed and reported by appropriate mechanisms, and properly retained.

Sustainability Development Committee

This committee, under the authority of the board of directors, shall perform the following duties with the care of a good administrator and report to the board:

1. 1.Formulate, promote, and strengthen the company’s sustainability development policies, annual plans, and strategies.

2. 2.Review, track, and revise the implementation and effectiveness of sustainability development initiatives.

3. 3.Supervise sustainability information disclosure matters and review sustainability reports.

4. 4.Oversee the execution of the company’s sustainability code of conduct and other sustainability-related tasks resolved by the board of directors.

Members of Functional Committee

| Title | Name | Education and Experiences |

|---|---|---|

|

Independent Director (Chairman) |

Ken-Tsai, Wu |

Please refer to the board member profile. |

|

Independent Director |

Shu-Hsing, Li | |

|

Independent Director |

Hou-Ming, Chen |

Members of Compensation Committee

| Title | Name | Education and Experiences |

|---|---|---|

|

Independent Director (Chairman) |

Shu-Hsing, Li |

Please refer to the board member profile. |

| Independent Director |

Ken-Tsai, Wu |

|

|

Director |

Hou-Ming, Chen |

|

|

Independent Director |

Xiu-Bi, Yao |

Special Committee on Merger and Acquisition

| Title | Name | Education and Experiences |

|---|---|---|

|

Independent Director (Chairman) |

Ken-Tsai, Wu |

Please refer to the board member profile. |

|

Independent Director |

Shu-Hsing, Li |

|

|

Director |

Hou-Ming, Chen |

Members of Sustainability Development Committee

| Title | Name | Education and Experiences |

|---|---|---|

|

Director(Committee Chair) |

Zhi-Li, Sun |

Please refer to the board member profile. |

| Director |

Hong-Ren, Yang |

|

|

Independent Director |

Hou-Ming, Chen |

|

|

Independent Director |

Shu-Hang, Li |

|

|

Independent Director |

Xiu-Bi, Yao |